Northern Oil and Gas, Inc. have provided an update to 2023 guidance and a preliminary second quarter financial and operational update.

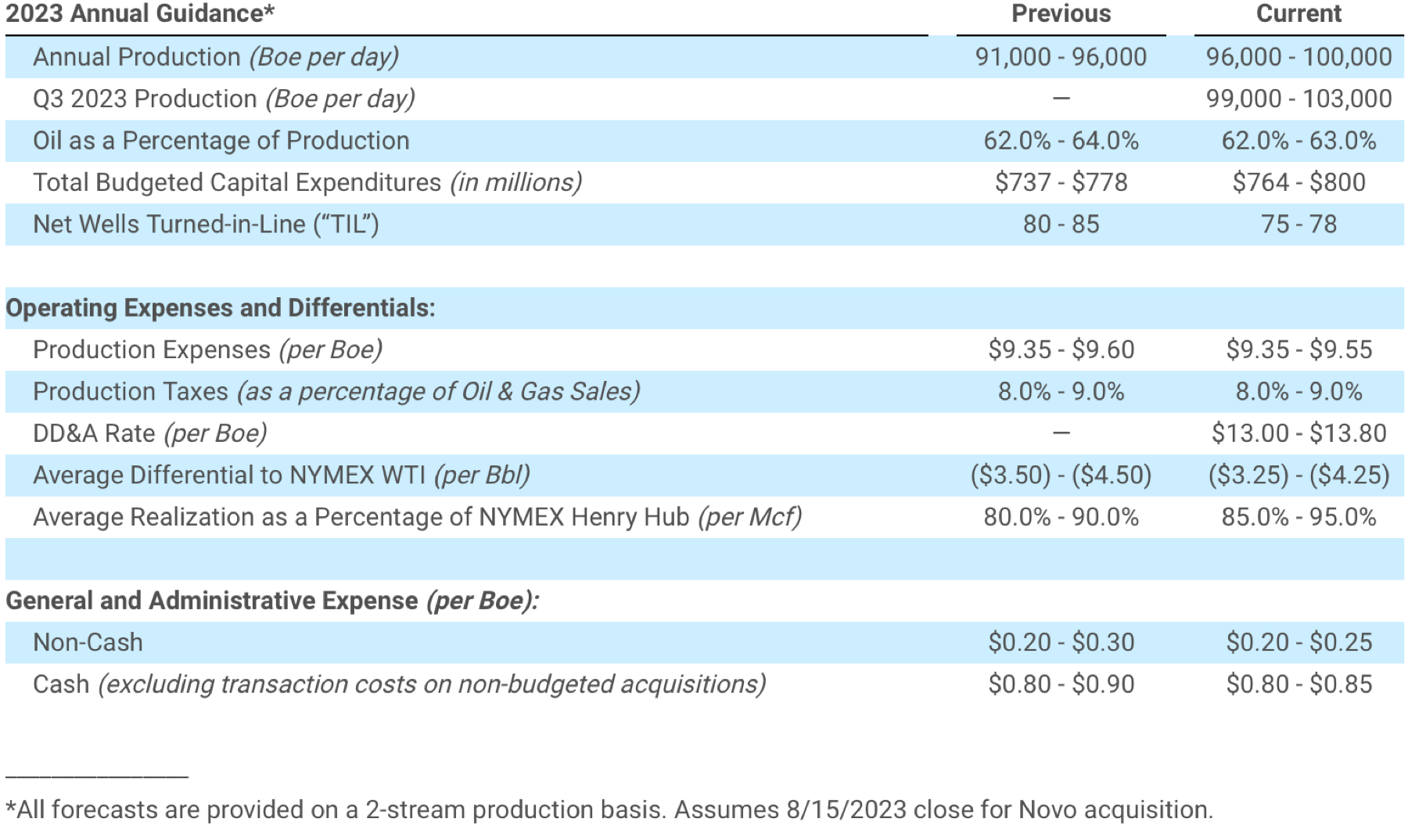

UPDATED GUIDANCE

NOG is updating guidance for full year 2023 to reflect the following:

- Increase to production estimates reflecting better than expected well performance, contributions from the Forge and Novo acquisitions, and adjustments for certain changes to drilling and completion plans in 2023

- Increase in budgeted 2023 capital expenditures driven by capital associated with the Forge and Novo transactions, offset by lower capital spending in the base budget

- Reduced per unit production expenses and G&A costs

- Improved oil differentials and gas realizations and adjustments to oil mix for acquired volumes

- Initiation of depletion, depreciation, amortization, and accretion (“DD&A”) unit guidance to aid calculation of adjusted earnings forecasts

INCREASED PRODUCTION ESTIMATES

NOG is raising its production expectations for 2023 to a range of 96,000 to 100,000 Boe per day (previously 91,000 to 96,000 Boe per day) reflecting strong well performance, contributions from the Forge and Novo acquisitions and adjustments for a lower expected TIL count in 2023. The TIL count and cadence changes are driven by modifications to the drilling plan for the MPDC Mascot project and by price-driven deferrals from a large Williston Basin operating partner. The Company is also adjusting the corporate oil mix to account for the acquired volumes. The Company also is guiding to production expectations of 99,000 to 103,000 Boe per day for the third quarter of 2023, based on an August 15, 2023 closing date for the Novo acquisition.

Well performance across all the Company’s active basins, including the Mascot project, has been stronger than expected to date. Production from the Forge and Novo acquisitions are reflected in the updated 2023 guidance, based on June 30 and August 15 (estimated) closings, respectively.

The Company and its operating partners are adjusting 2023 activity and shifting select development into late 2023 and early 2024. A portion of TIL deferrals relate to the Mascot project, where NOG and its partner have modified the completion schedule.

The modification to the Mascot drilling plan should materially improve well performance and reduce offset shut-in activity between batches. The new plan contemplates drilling and completing an increased quantity of wells (24 gross) in a single batch, as opposed to multiple stages; the focus on larger batches of wells will continue throughout the life of the project. Reduced downtime during drilling and completion should also moderate project costs. The longer spud to sales time for the larger batches will defer some previously scheduled fourth quarter activity (6.4 net TILs) into early 2024 and should drive further improvement to long-term project returns on capital employed.

In response to lower oil prices in the second quarter, NOG has experienced a deferral of TILs from a large Williston Basin operating partner, which had represented significant production additions originally scheduled for June 2023. The 3.8 net wells associated with the Williston Basin partner are fully completed but withheld from sales and are now expected to come online in late 2023.

REVISED CAPITAL EXPENDITURES

Total 2023 capital expenditures are expected to increase, at the midpoint of guidance, by approximately $24.5 million, to $764 to $800 million. The increase is comprised of an additional ~$37 million for the Forge and Novo acquisitions, offset by $10 to $15 million in reductions associated with changes to 2023 development plans. The capital spending associated with the deferred Williston activity and development capital associated with the Mascot project will still be largely incurred in 2023, even as the completion dates have shifted. NOG expects capital expenditures for the second half of 2023 to be equally weighted by quarter. The changes to drilling plans and TIL timing should provide uplift to production volumes and improved capital efficiency of turn-in-lines in 2024, as the Company will have already incurred significant development costs for many of the changes to the development schedule in the Williston and the Mascot project.

UPDATED ITEMIZED LINE-ITEM GUIDANCE

NOG is adjusting production expenses, oil mix, gas realizations, oil differentials and G&A expectations to align with year-to-date actuals as well as the impact of the Forge and Novo acquisitions.

Production expense unit guidance is being revised slightly lower. The Forge and Novo properties have lower production expenses than NOG’s previous corporate average, offset slightly by higher processing costs from increased expected gas realizations.

NOG has set improved guidance ranges for oil differentials and natural gas realizations, both of which have been better than expected year-to-date. Acquired production volumes will additionally provide benefit to oil differentials, given better in-basin pricing in the Permian basin.

Recurring cash and non-cash G&A costs are expected to decrease modestly driven by acquired volumes, the cash portion of which will be slightly offset by certain legal and accounting costs associated with the acquisitions that will not be removed as non-recurring expenses.

Per unit DD&A guidance has been added to reflect recent acquisition activity as the Company’s asset base has grown. As previously communicated during the Company’s fourth quarter conference call, DD&A for 2023 prior to the Forge and Novo acquisitions was expected to be in the range of $11.50 to $12.50 per Boe and is now expected to be $13.00 to $13.80 per Boe for the full year, inclusive of the acquisitions.

SECOND QUARTER FINANCIAL AND OPERATIONAL UPDATE

During the second quarter of 2023, the Company saw curtailments and deferments of wells turned to sales in the Williston Basin in response to lower oil prices. The Company estimates that its production was impacted in the quarter by approximately 900 Boe per day (~90 percent oil). The Company still expects to achieve record Williston Basin volumes in the second quarter. Despite the curtailments, the Company saw material production out performance across all three basins of operations, including the Mascot project. NOG expects second quarter production volumes to be 90.5 to 90.8 MBoe per day, but with lower quarter over quarter oil mix of approximately 60 percent driven in part by improved gas production from higher capture rates and the high oil-cut Williston deferments.

Total capital expenditures, excluding the acquisition of the Forge assets, are expected to be in the range of $231.0 to $236.0 million for the second quarter, in line with prior guidance and in accordance with the Company’s expectation of ~60 percent of the prior budget being incurred in the first half of 2023. For the second quarter, the DD&A rate is expected to be $12.85 to $13.00 per Boe. The increase to the DD&A rate is primarily driven by the closing of the Forge acquisition at the end of the second quarter.

Despite the deferments, the Company turned-in-line an estimated 13.1 net wells during the second quarter, delivering similar levels compared to the prior quarter.

The Company enters into derivative agreements to hedge a portion of its commodity pricing exposure. For the second quarter of 2023, unrealized mark-to-market gains on derivatives are estimated to be $29.5 to $30.5 million and realized derivative hedge gains are estimated to be $26.3 to $27.3 million.

MANAGEMENT COMMENTS

“NOG remains focused on maximizing returns on our assets,” commented Nick O’Grady, NOG’s chief executive officer, “We fully support our operating partners and the decisions driving some changes to the 2023 plan. We expect these changes to benefit our shareholders through higher realized prices and by driving down costs. Well performance continues to exceed our internal estimates, which sets the stage for further capital efficient growth as we look toward 2024. Our updated guidance also highlights the continued path of reducing unit costs and improving margins.”

“Some of the deferrals in the Williston are already proving fruitful, given recent significant improvements in realized oil prices in the field,” commented Adam Dirlam, NOG’s president. “With the Mascot project, we are thrilled with the results to date and continue to work with our partners to find ways to further improve project returns, reduce costs and augment long-term well performance.”

For more information visit www.northernoil.com