Global Partners LP, a leading integrated storage, distribution, and retail liquid energy company, has recently announced its plans to acquire 25 liquid energy terminals from Motiva Enterprises LLC. The terminals, situated along the Atlantic Coast, in the Southeast, and in Texas, have a combined shell capacity of 8.4 million barrels and will be purchased for $305.8 million in cash.

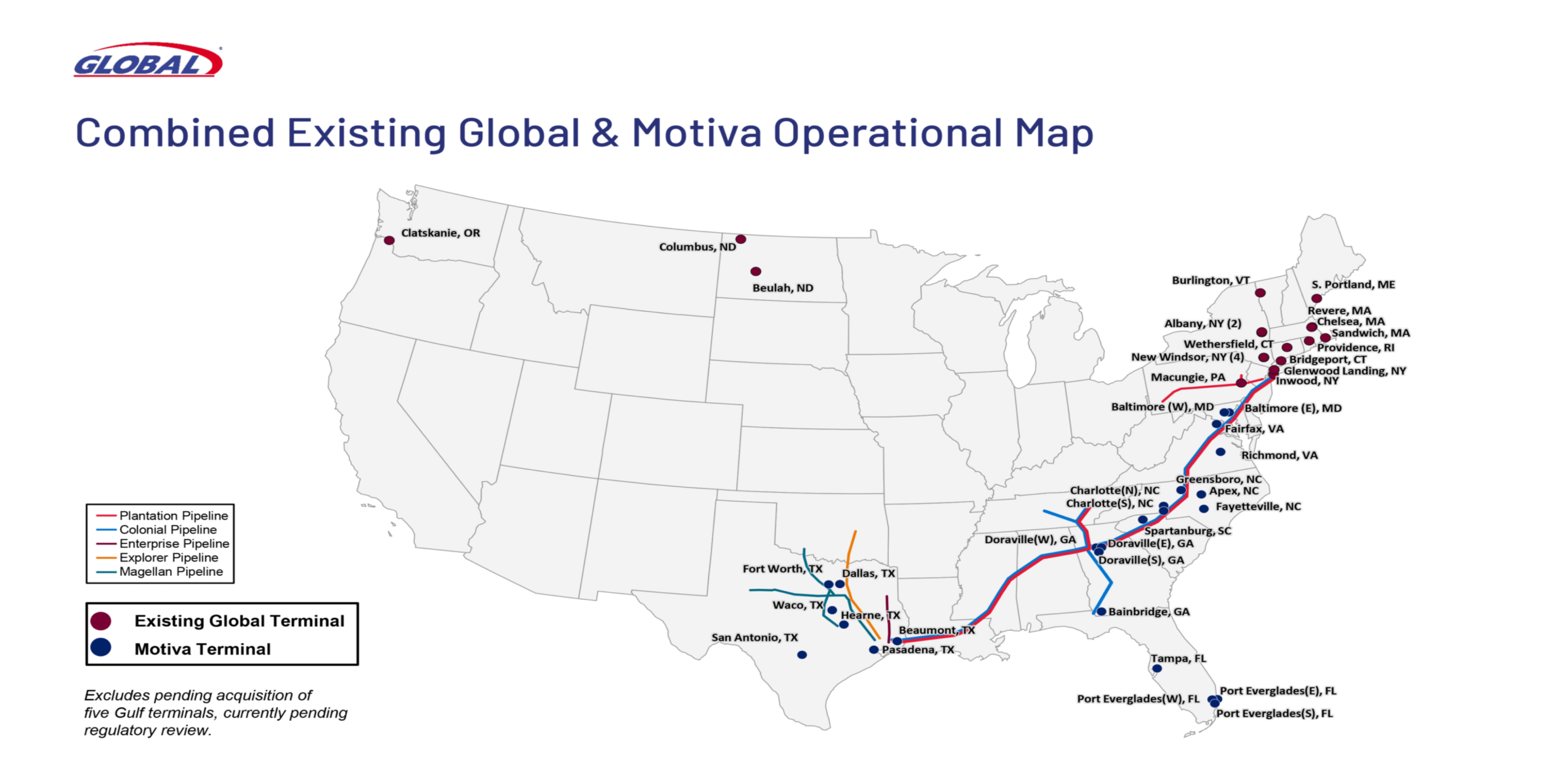

With this acquisition, Global aims to significantly expand its terminal capacity and geographic reach, extending its operations to cover the Atlantic Coast and the US Gulf. Currently, Global owns or leases 24 liquid energy terminals in states across the Northeast, North Dakota, and Oregon. Following the completion of this transaction, Global’s storage capacity will increase by approximately 85 percent to reach 18.3 million barrels.

Eric Slifka, president and CEO of Global, expressed enthusiasm about this strategic move, stating that it offers an exceptional opportunity to execute their growth strategy and create value by expanding into areas with growing population centers. He emphasized that these terminals will allow Global to leverage its expertise in supply and provide a platform for growth in all aspects of their business. The transaction is supported by a 25-year agreement with Motiva, ensuring long-term revenue commitments.

Motiva’s President and CEO, Jeff Rinker, shared his excitement about the partnership with Global Partners, stating that the divestiture of their product terminals will allow them to focus on strengthening and growing their manufacturing and logistics centered around Port Arthur Manufacturing Complex, while also supporting the growth of their marketing business.

The acquisition is subject to customary closing conditions and regulatory approvals, and it is expected to be completed by the end of the year. Global anticipates that the acquisition will be accretive to distributable cash flow per common unit in the first full year of operations, excluding transition-related expenses. The purchase price will be financed through borrowings under Global’s revolving credit facility. BofA Securities acted as the exclusive financial advisor to Global in this transaction.

For more information visit www.globalp.com